Our Services

Finance

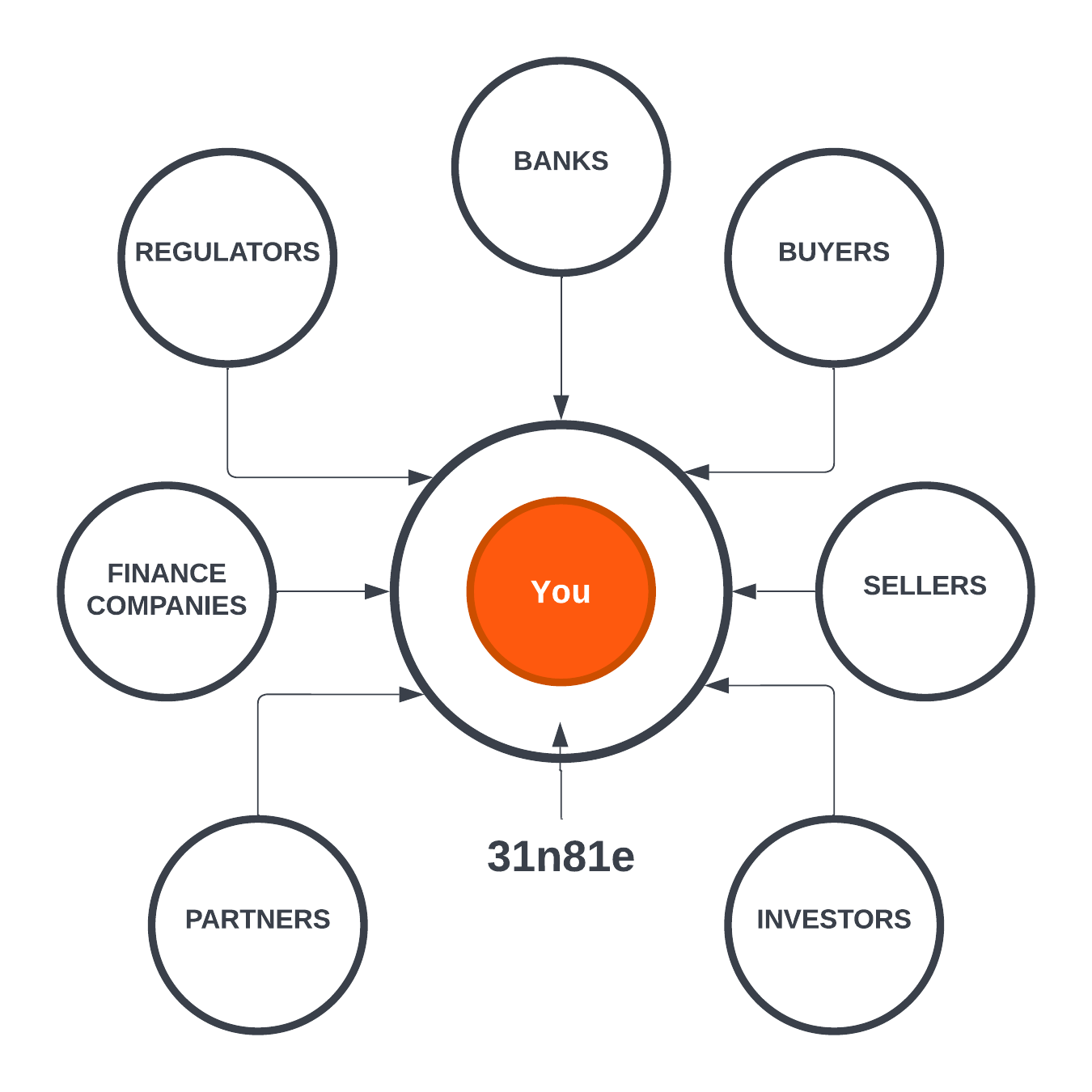

Leading enterprises and investors are seeking to create, collaborate and transact on business development and investment opportunities in the marketplace.

Leverage on 31n81e’s network of financiers, bankers and investors to accelerate your capital requirements today through equity, debt, IPO and or merger and acquisition options. We build and implement your plan with input from market leading experts to connect your funding requirements to your operational outcomes.

Deal Structure

Let 31n81e’s finance team guide you with evaluation of prospective acquisition, merger or partnering opportunities and the best corporate and operational structure to realise your goals. Our team will explore value chain drivers, market potential, competitive impact and optimal transactional structures to maximise the value of your acquisition/divestiture or partnership. Our multi-disciplined team will advise on feasibility, value, structure and negotiate multi faceted medium to large transactions to deliver a differentiated return on investment in your favour. Leverage on 31n81e’s association with private equity firms and presence in Australia to assist you scan and qualify partners, buyers, sellers and investors.

Identification

We work with you to distill the key issue that need resolving

Evalution

We generate options for you and work through these options with your team to determine the best course of action

Execution Excellence

We put your best option to work and coordinate all processes to ensure your outcome is delivered

Financing

Leverage on our network of banks and finance experts to assist you with funding options from debt to equity through to leasing models and Syariah compliant financing. 31n81e’s finance team will develop your strategy, prepare your information memorandum, identify your business case, negotiate best outcomes for your organisation and coordinate Our team will hand hold your organisation through the complete financing process to realise your best outcome.

We coordinate your strategy and work with you on all processes with all parties to deliver you your best outcomes

Merger and Acquisition

31n81e’s strategy and finance teams work together to help you integrate your merger and or acquisition quickly, effectively and with minimal stress on operations. We will help you identify potential partnerships and work with you to develop the strategy, execution plan, realise the desired benefits and coordinate the integration process to completion.

Ensuring your combined operations are running smoothly in the shortest time frame puts your profitability and growth back on track